Baker Tax Blog

Disproportionate Allocation of Deal Proceeds

Pretend you have a preferred equity investment in a company, entitling you to a 2x return before common holders participate in deal or liquidation proceeds. A buyout term sheet arrives, and while the valuation would only get you a 1.8x return, that’s more than enough,...

QSBS – Limits on Types of Assets Held

How do you pay zero federal tax on up to $10,000,000? Invest in a qualified small business. General speaking, a qualified small business is: A domestic C corporation; Which, at all times up to the time immediately following the issuance of your stock, had less than...

Stale 409A Valuation

Let’s say it’s March 2024 and you have some stock options you would like to grant members of your team. You’ve heard that you can rely on a tax code Section 409A valuation for up to 12 months. You received a valuation of $0.30 per share effective as of December 31,...

Section 174 Expensing

Certain recent changes to tax code Section 174 may negatively affect companies that have research and development (R&D) expenses. Here’s the basic problem: If in 2023 you spent $1M to make $1.2M then you have $200K of profit. If we lived in a perfect world, you...

Section 351

Let's say you have some intellectual property (IP) that you'd like to give to a corporation in exchange for shares of its common stock. The IP and stock are both worth $10,000 and you have tax basis in the IP of $800. Normally such an exchange would trigger $9,200 of...

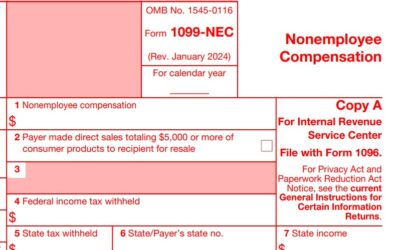

Form 1099-NEC and Legal Services

It's 1099 season. For those of you who paid a law firm for legal services this year, here are three tips: 1. Payment for legal services goes in box 1 of Form 1099-NEC. Do not use Form 1099-MISC. Form 1099-MISC box 10 "Gross proceeds paid to any attorney" is for when...

Liquidating after an Asset Sale

Let's say you're the majority shareholder of ABC, Inc., a C corporation, which just sold substantially all of its assets in a taxable asset sale. The deal consideration consists of three parts (i) $30M to be paid at closing, (ii) $3M which is being held back in an...

SAFEs in LLCs

Updated. Originally posted September 14, 2019. Once there was a beautiful tech incubator named Y Combinator. In a dream one night she saw herself curing every start-up’s funding woes with a magical new creature called a SAFE. When she woke up, she got to work creating...

Exercising Shortly Before Closing

So, your company is being sold and you want to know whether you should exercise your stock options prior to closing. First you should confirm whether the transaction agreement (i.e., stock purchase agreement, asset purchase agreement, or merger agreement) provides...

Partnership Equity

For tax purposes, there are three types of equity that can be issued in a partnership or an LLC taxed as a partnership: capital interests, profits interests, and carried interests. Knowing what type of interest you own or are being granted is important, because there...

Convertible Notes

So, you started a business and you issued a convertible note. You know, a loan that can be repaid with the equity of your start-up. The date of the note conversion has arrived and you’re busy calculating how many shares you need to issue when suddenly you get an...

Year-End Tax Moves

You have three months left in 2023. There’s still time to save yourself some tax. Here are ten ideas: 1. Do you own or run a company that is a cash basis taxpayer? Consider paying all outstanding invoices by December 31, so you can take the deductions this year. Reach...